Digital Banking & Payments

Venue: London, Dubai, Singapore, Hong Kong, Sydney

Or On-Demand In Your City

- WED 07 December, 2022 - LIVE!

- Or WED 26 April, 2023 - LIVE!

- Registration Fees:

- Early-bird price: US$3750

- US$4750 after 31 Oct 2022

Why attend now?

Digital has revolutionised global banking!

To survive and thrive, financial services businesses must TRANSFORM at pace to meet the new demands.

LinkedIn Data reveals more than 152,000 jobs across the planet for digital finance professionals.

Fast-changing shifts in technology and consumer behaviour have left many unprepared. You now compete with FinTechs and digital players for customers’ attention and wallets.

Upgrading technology is only PART of the answer.

To succeed in this fast-paced digital world requires a grasp of disruptive forces at play, mastering data to engage today’s digital customer. And embracing a digital mindset for new ways of working and collaborating.

What’s In It for You?

- How Central Bank Digital Currencies. Crypto & future APIs will play out

- How to unlock Blockchain and Distributed ledgers in digital payments

- Global best practices in digital channels/ products

- How Digital Banks will evolve to serve Millennials and GenX

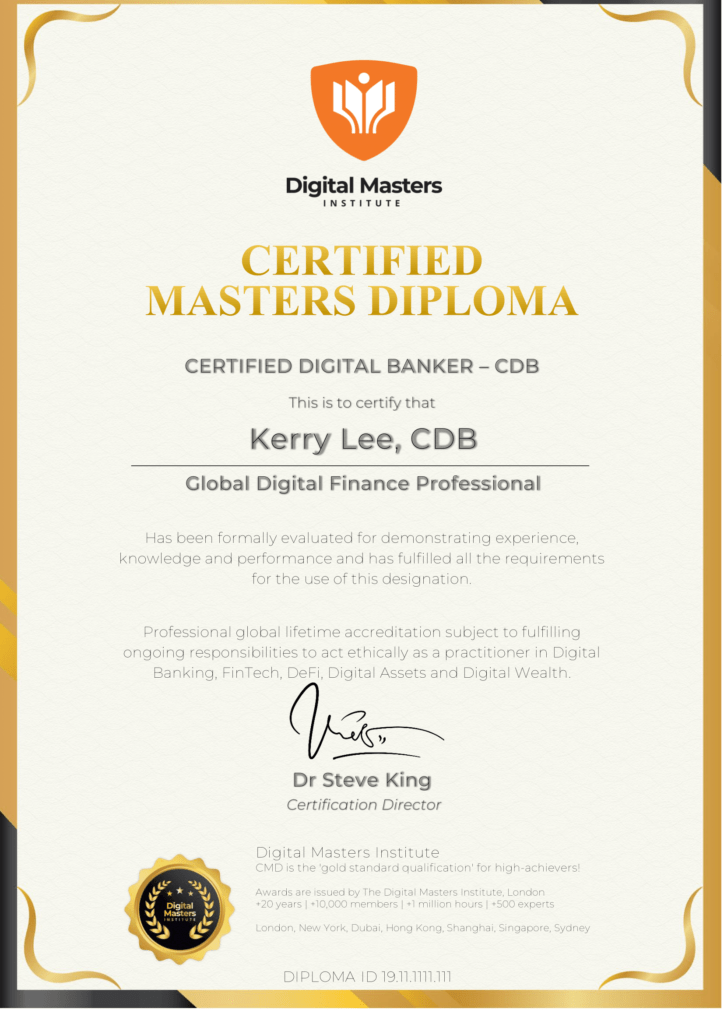

- You will achieve the prestigious, globally-recognised professional qualification of Certified Digital Banker (CDB) to enhance your CV and career biography

You’ll position yourself as both an authority and thought-leader in an area with stellar growth to come!

Learn From The Best. Case studies, tools and insights

Book your ticket now!

Receive a bunch of EXTRA bonuses to rocket-charge your success!

What You'll Gain

Digital disruption and rapidly evolving consumer behaviour are powering the fastest transformation ever seen in the age of modern finance.

This programme gives you everything you need to master this discipline

DeFi: decentralised finance: digital banking, payments, fintech, digital assets, digital wealth and much more.

LOCATION

One-Day Summit

Live, Virtual & On-Demand

WHEN

26 Oct, 2022

26 April 2023

AWARD

Certified Digital Banker (CDB)

Masterclass Schedule

Live Agenda

Tailor-Made For You!

Learn From The Best

This Masterclass will be presented by up to two members of our Expert Masters Faculty Panel.

See their profile and credentials below

This format ensures that we focus on meeting your unique needs. So you get the most relevant practitioners to help you get certified as a leading professional in this high-growth sector.

Digital Banking: Learn From The Best

9.00 – 10:45 am

Session 1

Digital Banks: Setting the scene

FinTech - Evolution & Revolution

- 30 Key Emerging Areas of FinTech

- New Players: FinTech Startup, TechFin Giants, Neo Banks, MNOs (Mobile Network Operators)

- Digital Transition Project: The Red Queen Effect, Evolutionary Biology in Banking, Banking Innovation Paradox, Moore’s Law and Metcalfe’s Law, Information Cascades

Millennials & Gen-Z - Need Digital Experience

- Millennials and GenZ: Lethal Digital Divide, Demographic Trends, ‘The Instant Generation’, Differences in Time-Perception

- Design: User Experience is the New Product, Interface Defines UX, Design Defines

- Interface: Steve Jobs Interface Test

- Loyalty: The Third New Dimension of Loyalty, Extended Loyalty, Digital Lock-In Effect, Participative Benefits

Digital Channels

- Social Media: FB, YouTube, Instagram, Web 3.0

- Smartphone: tool of aggregation in – and beyond – finance

- Emerging Channels: Chat, Smart Speakers, Conversational AI

- Future: Smartwatch, Wearables, Hyper-connectivity, IoT (Internet of Things), Augmented Reality, Virtual Reality, Smart Lenses

- Case Studies: ASB Bank NZ, Deutsche Bank, Toronto Dominion Bank, ABSA Bank South Africa, Emirates NBD UAE, Alibaba China, Samsung and Kakao Bank, South Korea

Digital Product Development

- Crowdsourcing: Open Social Techniques, Digital Ethnographic Research

- Digital Market-Research: Virtual Focus Groups, Social-Listening, Research Gamification, Natural Language Robots

- Product Development Best Practices: Big Data, Informal Networks, The 4 ‘P’s of Product Development, Roger Scale of Market Timing

- Case Studies: Westpac Australia, ICICI Bank, India

- Group Exercise: The Three Key Sources of FinTech RISKS

10:45am-11:00am

Morning Networking Break

11:00 – 12:30pm

Session 2

Strategic Challenges

Blockchain and Distributed Ledger Technologies 1.0

- History & Redefinition: Centralized versus Distributed Ledgers, The 7Ps of Blockchain Evolution, Public versus Private Ledgers

- 10 Phases of Blockchain Demonstration: Hash, Block, Blockchain, DLT, Value, Value Base, Public Key, Private Key, Signature, Integration

- Use Cases: 30 use cases of Blockchain in banking, key use cases beyond banking

- Group Exercise: Use Case Prediction

Blockchain and Distributed Ledger Technologies 2.0

- Interbank Money Transfer: SWIFT, R3 Alliance, Ripple Labs and beyond, Blockchain-Based Remittances

- Identity on Blockchain: New Banking, Denmark, KYC Chain and Block Pass from Hong Kong

- Smart Contracts: Definition, Characteristics, Roles, How banks and bankers can profit, How lawyers can remain relevant

- Central Banks and Blockchain Projects: Federal Reserve, Bank of England and others

Open Banking: From concept to reality in the UK

- The Firsts Steps: Competition and Markets Authority, Open Banking Implementation Entity

- The Second Steps: Research, Standards, Participants

- Turning Point: 1st January, 2018 and the 20 Registered 3rd Parties

- Case Studies of UK Open Banking 3rd Parties: Bud, Credit Data Research, MoneyBox, Flux Systems, GiffGaff, Yolt, MoneyHub

The payments services directive 2 and beyond: global implications

- 10 Years of history: From SEPA to PSD2

- XS2A: The key aspect of PSD2 and why it is dangerous

- Leading Global Experts on PSD2: 3rd Parties, Negative Data-Spirals, D-Day in 3rd Party Banking

- RTSs: Regulatory Technical Standards, NextGenPSD2 by Berlin Group, STET, Polish API Alliance

- The World of API Developer Portals: Credit Agricole, Capital One, HSBC, BBVA, Standard Chartered, Nordea, OCBC, Monzo & Fidor

12.30-1:45pm

Networking Lunch for Delegates & Guests

1.45 – 2.30pm

Session 3

New Risks, New Answers

Digital Currencies

- Lessons from Monetary History:

- A 17th Century Crisis, Ken Rogoff – The Curse of Cash, AML, KYC, Compliance

- BitCoin: Nakamoto, Bitcoin Foundation, PayPal’s Attempts for Currency

- Secondary Coins: Ether, LiteCoin, DashCoin, XRP by Ripple

- Key Cryptocurrency Concepts: ICOs, ABCs, Crypto ATMs

- Central Bank Digital Currency: Sweden, Thailand, South Africa, Ireland; Commercial Bank Digital Currencies

Big Data, Risktech and Ecosystems

- Social Media Credit Scoring: Friendly Score, Sesame Credit, Kabbage

- Loyalty: Informal Networks, Vodafone, Alpha Rank

- Insurance: Telematics by Smartbox, Vitality

- Payments and Beyond: YouPay, RiskIdent, BehavioSec, GDPR

- Risk Management Technologies: Rapid Ratings, Environmental Rating Agency, Sigma Ratings, NetGuardians, Risk Dashboards

- Digital Ecosystems: WeChat, JD Finance, Discovery, Ant Financial, Starling Bank, Platformification

2:30-2:45pm

Networking Break

2:45 – 4:00pm

Session 4

Digital Wealth

Roboadvisors and AI Propelled banking channels

- Roboadvisors: Key trends in ‘WealthTech’, From 1st Gen of Roboadvisors (the Hybrid Model) to 2nd Gen (Microsavings), Roboadvisory Paradox; Market forecast advisors (AlpacaJapan, AlgoDynamix)

- Understanding AI in Banking: AI versus Automation, Front/Middle/Back Office AI Applications, Human vs Machine Intelligence in Banking

- Voice Banking: Alexa, Siri, Cortana, Google Assistant

- Chat Banking: Monese, Kasisto, Finn AI, Chatbots by Sociodemography

- New Frontiers: NLP in Banking, Emotional Analysis

4:00-4:15pm

Networking Break

4:15 – 5:00pm

Session 5

Innovation Strategies

- Primary Strategies: The Christensen Strategy, The Ambidextrous Organization Strategy, The Toyota Strategy

- Secondary Strategies: The TRIZ Strategy, The Three Horizons Strategy

5:00 – 6:00pm

Session 6

Summary, Wrap, Accreditation Awards

- Your questions answered

- Q&A - Concepts, Tools, Trends, ‘To-Do’s, Resources

- CDB Awards Certificate Presentation

Who Should Attend?

- CEO, C-Suite & Boards

- Digital Transformation Project Teams

- Directors: Strategy, Compliance, Data, Risk, HR/People, CyberSecurity

- Advisers: Analysts, Engineers, Lawyers, Auditors

- Investors and PE/VC/Corporate Finance/M&A

- Government / Regulators

- Educators / Recruiters / Business Developers / Marketers

Expert Faculty Panel - Digital Banking

Expert Panel

Robert Taylor

Digital Transformation Expert Course Director for Google, MIT, University of Cambridge and Columbia Business School

Rob Taylor is a digital strategist specialising in Digital Transformation, Digital Banking, Customer Journey mapping, Website & App User Experience and Ecommerce

He works with clients to develop their digital strategy and digital transformation roadmaps.

Rob helps clients build digital skills and capabilities through his roles as:

Course leader on Digital Disruption, Digital Business Strategy and Digital Marketing Strategy programs for MIT, Cambridge Judge and Columbia Business Schools

Lead trainer for Google Digital Academy

Rob has designed and delivered digital banking programmes for financial services businesses globally, including HSBC (HK, London, Dubai) Abu Dhabi Commercial Bank & Al Hilal (Abu Dhabi), Amex (Mexico) Dubai Islamic Bank (Dubai) FAB (Abu Dhabi) Mashreq (Dubai) ING (Nordics), Santander (Europe) L&G (UK) Lloyds Banking Group (UK) QNB (Qatar), UBL bank (Pakistan) UOB (Indonesia)

Rob works and travels extensively across Europe, US & Canada, the Middle East & APAC markets.

Dr Dennis Khoo

Creator of the FIRST digital bank in ASEAN

Hands-on Implementation Experience

Best-Selling Author of:

‘Driving Digital Transformation’

Dr Dennis Khoo is an accomplished digital business leader and speaker in innovation and leadership.

Armed with dual experience in Information Technology and Banking, he has a unique advantage in developing and executing strategies for the transformation of businesses in a digital world.

Dennis was a senior banker who had previously run billion dollar businesses as head of consumer bank for Standard Chartered Bank and UOB in Singapore.

He was responsible for many of the innovations in the consumer banking industry in Singapore, such as e$aver, XtraSaver (Winner of Asian Banker Best Deposit Linked account in 2007), Retail Bonds, Step-up time deposit, Pay-Any-Card (Winner of Asian Banker Best Payment Product in 2011), 15% Dining Cashback everywhere, 2-day Mortgage Service Guarantee, UOB Income Builder, One Account and UOB Mighty App.

A digital bank pioneer in ASEAN, Dennis was global head of TMRW Digital Group (UOB’s Millennial digital bank), where he was responsible for the strategy, growth and delivery of the TMRW Digital Bank.

The first TMRW Digital Bank ( www.tmrwbyuob.com ) went live in Thailand in 2019, and the second in Indonesia in 2020.

TMRW won Global Finance Most Innovative Digital Bank in Asia Pacific in 2019.

Dennis also led the joint venture initiatives into Fintechs like Avatec.ai and VUI Pte Ltd as part of the ecosystem to support the growth of TMRW.

Dennis was previously CEO-Designate in one of the consortiums bidding for the digital bank wholesale licence in Singapore.

Dennis is a WABC (Worldwide Association of Business Coaches) Registered Corporate Coach, a certified Gallup Strengths coach, and accredited in Harrison Assessment Employee Development.

Dennis has mentored and coached many successful executives in his long career.

Dennis is a sought after lecturer and trainer, and is involved in the LYT program at the NUS School of Business MBA and the Enterprise Leadership Training for SMEs in collaboration with NUS and the LinHart Group.

He has also taught the Corporate Strategy course for the NUS MBA program as adjunct Professor.

Dennis holds a degree in Engineering and a Masters in Business Administration from the National University of Singapore.

He also has a Masters in Business Research and a PhD in Business Administration from the University of Western Australia.

Dennis was awarded a Doctor of Philosophy for his work in international business which broke new ground in the understanding that firm specific advantages drive performance and internationalisation is a moderating factor and not a driver of firm performance.

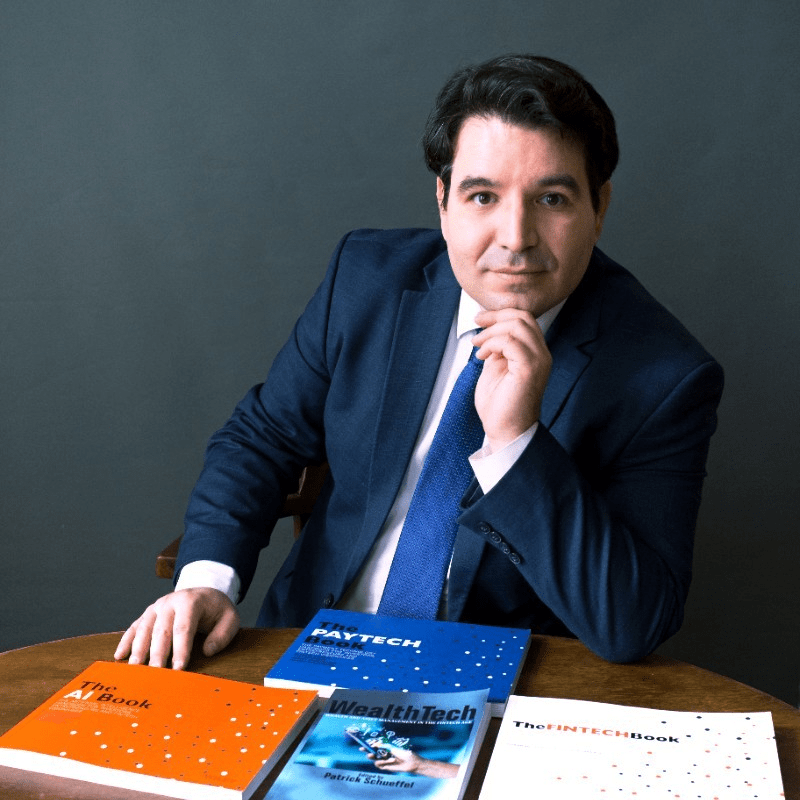

David Gyori

CEO at Banking Reports

London, United Kingdom

Top 10 Global Thought Leaders in FinTech

David Gyori is considered one of the top ten thought leaders in FinTech. He is a founding member of the World FinTech Association. He is also a member of the Panel of Judges of the European FinTech Awards. His book ‘The FINTECH Book,’ published by Wiley & Sons in 2016, became a best seller in the global category soon after release. He is also a faculty member in the Retail Banking Academy of London.

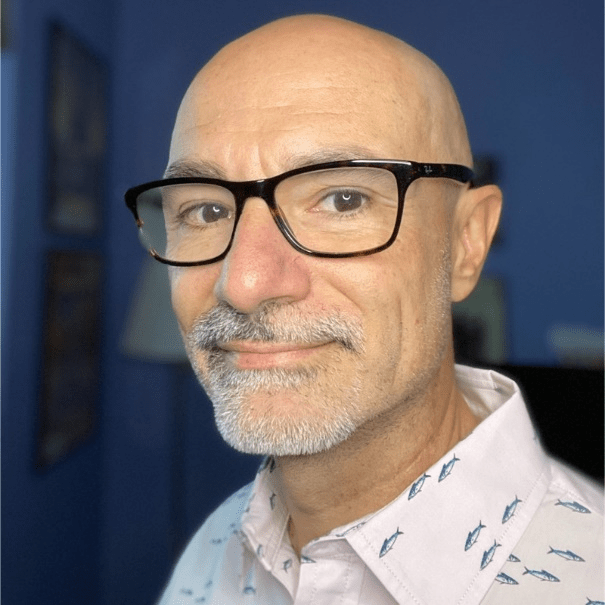

Alex Jiménez

Managing Principal, EPAM's Financial Services Newtown, Pennsylvania, United States

Alex Jiménez is the Managing Principal of EPAM's Financial Services. He has more than 26 years of experience in Digital Banking and Payments. He served as the Chief Strategy Officer at Finalytics.ai, worked at Zions Bancorporation, Rockland Trust, Bank of America, FleetBoston Financial, and Cigna Insurance.

He was the Chair of the Consumer Bankers Association’s Digital Channel Committee. He is also a founding member of the American Bankers Association’s Fintech Committee.

He has been featured by The Financial Brand, Finovate, CFO Outlook, CIO Insights, and Credit Union Times. He has been quoted in the Wall Street Journal, the Boston Globe, The Financial Brand, the American Banker, and the Boston Business Journal.

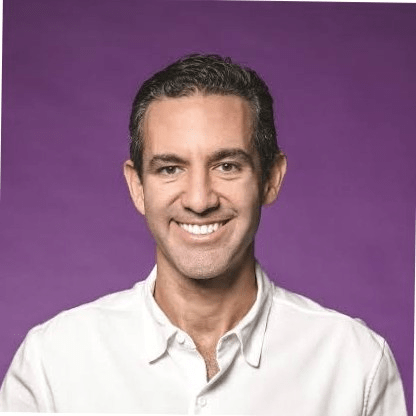

David Vélez

Founder and CEO

Nubank, the largest fintech bank in Latin America,

São Paulo, State of São Paulo, Brazil

David Velez is the co-founder and CEO of NU Holdings. It has been featured as the most valuable startup in Latin America. This company offers different services, including fintech services. The most popular fintech product of NU Holdings is the Nubank. It has more than 48 million customers and is the largest fintech-based bank in Latin America.

Chris Britt

Co-founder & CEO

Chime, A Fee-Free Mobile Banking Service,

San Francisco, California, United States

Chris Britt is the founder and current CEO of Chime. The Chime is an innovative digital banking system and the first-ever fee-free banking service in the United States.

His innovation is not only making the financial system better but also disrupting the existing way of banking. From 2007-to 2012, Chris worked as a Chief Product Officer and SVP at Corporate Development at Green Dot. Chris also worked as a senior product leader at Visa. His expertise in digital banking and disruptive innovation has made him a well-known and appreciated person in this era.

Zilvinas Bareisis

Head of Retail Banking at Celent, London

Zilvinas Bareisis is a digital banking & payment expert currently holding the Head of Retail Banking position at Celent. The banking technologies related to card-based payment and identity authentication are his field of research. He has more than 20 years of experience in leading financial institutions and technologies related to finance.

Todd Ablowitz

Co-CEO &Co-Founder at Infinicept, Denver, Colorado, United States

Todd Ablowitz is a globally recognized expert on digital payment technology. He has over 20 years of experience in leading software companies, financial institutions, and sponsors developing digital payment infrastructure. Because of this diverse experience, and serial success in launching financial products, he has become one of the first choices as digital banking & payment advisor and consultant.

Oliver Bussmann

CEO & Founder

Bussmann Advisory AG,

Zürich Area, Switzerland.

Oliver Bussmann is considered one of the most influential FinTech and Digital Financial Services leaders. He has over 30 years of experience working in key industry leaders, including UBS, SAP, Allianz, Deutsche Bank, and IBM, in various finance-related technical fields. His expertise encompasses FinTech, Blockchain, Enterprise Mobility, and Cloud Computing. He is considered a pioneer in spotting trends and employing business-building social media strategies from the CXO role.

Neira Jones

Independent Advisor

Payments, Digital innovation, Fintech, Cyber Risk & Information Security,

London, United Kingdom.

Neira Jones is a globally reputed financial service and technology expert. Her expertise ranges from digital banking, payment, innovation, fintech, cyber risk, and information security. In her 20 years of experience in this field, she advised hundreds of organizations on digital banking & payments, crypto-currency, Blockchain and information security.

Key Takeaways and Learning Outcomes

- How this “ecosystem” works - players, terminology, future directions

- How banking must deliver - when and where you need it

- How customers of the future will demand real time support: in advice, service, location, speed, delivery and impact

- How client behaviour is changing: Big Data, Mobility, Gamification

- How to apply your knowledge to manage seamless platforms and tools

- How Digital Banking skillsets and mindsets will evolve

- How to prepare for what’s next - your leadership and career impact

After completing this course, you will achieve the globally-recognized prestigious Certified Masters Diploma CMD Badge. Become a Certified Digital Banker. This Masterclass prepares you to seize future opportunities.

“The knowledge you will gain, the skillset you will develop, the technologies you will learn, and the strategies you will practice in this masterclass will prepare you as one of the most valuable Digital Banking & Payment experts on the planet”

10+ Bonus Extras worth $12,850

This Masterclass Sprint produces maximum output in minimal time.

To progress and scale quickly, you need to cultivate the confidence of applied working knowledge in your key meetings with senior leadership teams and boards.

You will position yourself as a trusted industry authority. Understanding the future of digital banking through facts and analysis – supported by hard numbers, data and trends. Intuitive real-world practice, not academic theory.

This Masterclass also helps you build a strong professional network. It provides a sound base for lifelong-learning. No matter how tech evolves, you’ll always be able to APPLY your knowledge and experience built on sound foundations.

It prepares you for all possible scenarios you will face.

Step-by-step, session by session.

Here’s how.

- Build Confidence

- Tech-Knowledge

- Essential Skills

- Strategies to Apply these Skills

- Prepare for the Future

So, you decide if you want to rise with the best or stand with the rest. If you’re going to grow as the best and thrive in your career, there is no better option than taking this masterclass.

Gain your certified masters diploma

CMD is the ‘gold standard qualification’ for high-achievers! Get prepared to truly transform your business.

- Gain DEEP industry “insider” knowledge

- Practical, hands-on experience & insights from fast-moving, innovative companies

- Real transfer of knowledge

- Distinguished credentials from the world's top business schools and from real-life use cases

Real Results = Greater Impact

Customer experience means everything to us. Listen to what people like you are saying…

Trusted By The World's Top Brands

Book Now & Save $$!

Avoid the Wait List. Prices rise by $1000+ very soon…

(And only 7 seats remaining as of this minute…)

RECOMMENDED FOR YOU

View All Certified Events…

Private Credit Masterclass

LIVE from July 2022...

Entrepreneurship Strategy Bootcamp

LIVE from July 2022...

Project Finance Academy

LIVE from July 2022...

Real Estate Modelling

LIVE from July 2022...

Corporate Finance & Valuation

LIVE from July 2022...

MBA in Financial Management & Profitability

LIVE from July 2022...

Financial Modelling & Power BI

LIVE from July 2022...

MBA in Oil, Gas & Clean Energy

LIVE from July 2022...

CyberSecurity Certified

LIVE from July 2022...

Data Science & Visualisation Certified

LIVE from July 2022...

Blockchain, Crypto & NFT Certified

LIVE from July 2022...

Private Equity 2.0 Certified

LIVE from July 2022...

Artificial Intelligence Certified

LIVE from July 2022...

Sustainability & ESG Certified

LIVE from July 2022...

Digital Transformation Certified

LIVE from July 2022...

Certified Digital Banker

LIVE from July 2022...

Certified Diplomas For Successful Executives

We reach 350,000+ senior professionals: CEOs, Directors & Investors. PARTNER with us to access the right clients worldwide!