Private Equity 2.0 Masterclass

- Wed: 26 October 2022 - LIVE!

- or Wed: 26 April 2023 -LIVE!

- One Day Masterclass Summit

- Live, Virtual, or On-Demand

- LON, Dubai, Singapore, Sydney

- US$3750 /person before 01 July

- US$4750 /person AFTER 31 AUG

Why attend now?

> How To Navigate Higher Cost of Capital, Inflation and Strong USD

> Restructuring Existing Deals

> Liquidity and Mark-to-Market

> Getting Solid Deals Done In 2023 and beyond

According to Private Equity International’s Fundraising Report, more than $733 billion in the capital was raised by private equity 2021.

At the end of 2019, private equity-backed companies employed more than 10.2 million employees.

This Masterclass is your perfect springboard for success in Private Equity & Corporate Finance.

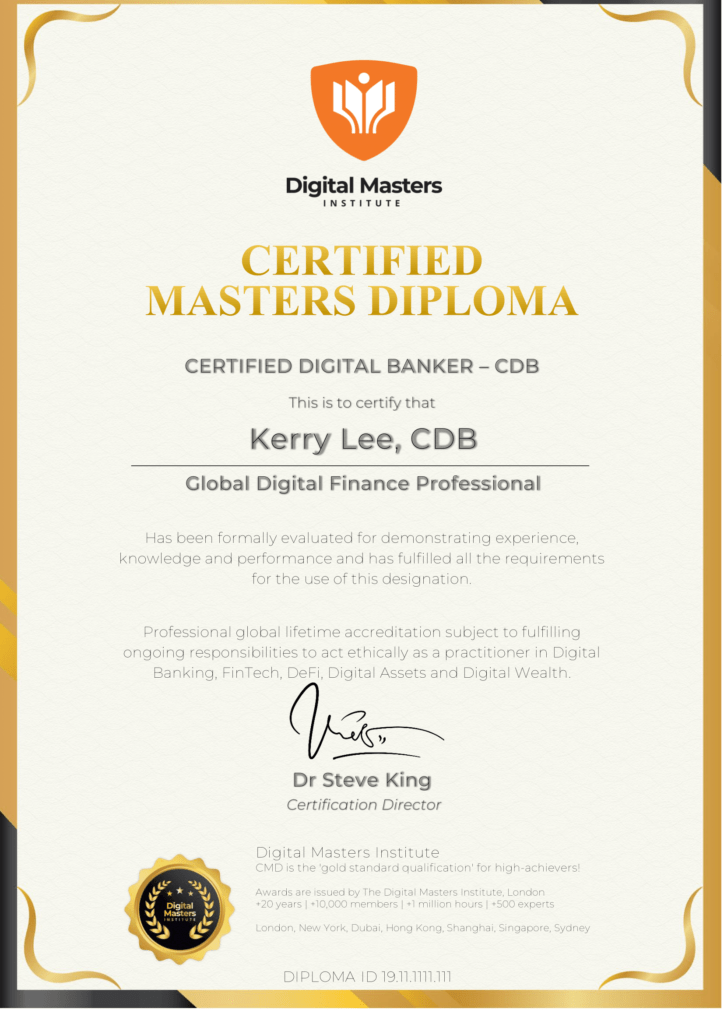

On completion, you will achieve the prestigious, globally-recognized Certified Masters Diploma Badge and the professional qualification of Private Equity Certified (PEC) to enhance your already impressive career journey.

Case studies , tools and insights you can apply right away...

Book your ticket now!

Receive a bunch of EXTRA bonuses to rocket-charge your success!

What you'll Gain

This program has been specially designed by analyzing the market demand for the skills in Private Equity to prepare you to be a successful Private Equity practitioner.

Get the right practical credentials to back up your industry experience.

LOCATION

One-Day Masterclass Summit

WHEN

26 Oct, 2022

26 April, 2023

9am to 6pm

Or On-Demand

AWARD

Private Equity Certified (PEC)

Masterclass Schedule

Live Agenda

Tailor-Made For You!

This Masterclass will be presented by up to two members of our Expert Masters Faculty Panel.

See their expert credentials below

This format ensures that we focus on meeting your unique needs. So you get the most relevant practitioners to help you get certified as a leading professional in this high-growth sector.

09.00 – 11am

Session 1

Private Equity & Corporate Finance – The Big Picture

- The basic and applied terminologies of Private Equity (PE) and Corporate Finance 2.0

- Seed, Startup & Early-Stage Financing in Private Equity

- Core functions involved in Corporate Finance 2.0

- The big picture encompassing the Private Equity and Corporate Finance

- Case Study on Private Equity and Finance Expansion

- Interactive discussion on a real-world scenario

11:00 – 12:00pm

Session 2

The Background to Successful Negotiation

- Behind the scene of Private Equity

- Best practices in different phases of the Private Equity deal

- Common structure of Private Equity deal

- The investment flow cycle and evaluation

- Key factors of due diligence

- Strategies for successful negotiation

- Observational & supervised exercise

12.00-1:30pm

Networking Lunch for Delegates & Guests

1.30 – 2.30pm

Session 3

Funding Sources – Tactics to Practical Application

- Discovering funding sources – Private Equity and Venture Capital

- Debt and Equity – digging deeper in fundraising

- Ins and Outs of Debt & Equity in the eyes of professionals

- Practical Alternatives in Funding

- Tactics to deal with alternatives

- Observational & supervised exercise

2:30-3:00pm

Networking Break

3:00 – 4:00pm

Session 4

Handling Legal Issues and Taxation

- Key concepts of local & global funds

- Best practices to work with investment firms and banks

- Dealing with management fees

- Managing heterogeneous local & global legal issues

- Working with international taxation

- Step-by-step training in handling legal and tax issues

4:00-4:30pm

Networking Break

4:30 – 6:00pm

Session 5

Private Equity Management

- The key ideas of Private Equity Management

- Different phases of management

- Effective monitoring tactics

- Case study on actual Private Equity Management problem

- Advice for Entrepreneurs

4:30 – 6:00pm

Session 6

Dealing with Mergers & Acquisitions

- Merge VS. Acquire – The investor’s dilemma

- Evaluating a deal

- Training on LBO Model Analytics

- Key differences between public and private deals

- Designing the offer structure

- Reviewing the local and international regulations

- The art of defensive & attacking strategies during a bid

- Case study on bidding scenario

4:30 – 6:00pm

Session 7

The Success Strategies in Private Equity and Corporate Finance 2.0

- The common mistakes investors make

- The frequent challenges

- Key strategies to avoid making mistakes and beat the challenges

- The professionals’ advice

- Discovering, if not possible, then preparing an insightful exit plan

- Interactive discussion

Who Should Attend?

- CEO & Boards

- C-Suite: CFO, CIO/CTO/CMO

- Directors of Strategy, Data, Compliance, Human Resource, Risk, Security

- Analysts

- Investors and PE/VC/Corporate Finance/M&A specialists

Expert PE & Corporate Finance Faculty

Expert PE Panel

Gavin Ryan

Mid Cap Private Equity Fund Manager, Consultant, and Trainer

Gavin Ryan is 20+ years experienced mid-cap private equity fund manager. He is also a consultant and corporate trainer. He has experience working in the private equity sector of Europe, Africa, and the Middle East. The funds managed include CEE AG, a renewable energy asset manager with €2.5bn under management, a Soros fund Management $200m European Private Equity Fund, and an Advent International $30m country fund.

He is also an Advisor to PE funds and Limited Partners. He acts as a Non-Executive Director and has served on the Boards of several companies and banks.

John Colley

Online Training Courses,

Online Marketing Consulting, and Keynote Speaker,

Six Minute Strategist Consulting,

Oxford, United Kingdom.

John Colley is a 30 years experienced investment banking trainer. His unique combination of corporate strategy experience with modern online marketing skills drew numerous attention of investment banking enthusiasts globally. He has helped hundreds of clients since 1988. And taught over 60,000 students online since 2014. His area of expertise is Business & Strategy Planning, Investment Banking, Corporate Finance, Capital Raising, Startups, Venture Capital, Private Equity, Company Sales, Corporate Exits, Online Marketing, Social Media Marketing, Public Speaking, Coaching, Consulting, Online Courses, Training, Business Coach, Voiceovers, Presentations and Webinars.

Mark Florman

CEO Time Partners Limited

Mark Florman is the CEO of Time Partners Limited. He is a British businessman and entrepreneur. He is also the co-founder and former of the merchant banking group, Maizels, Westerberg & Co. He is a well-known and globally recognized finance expert. He has been featured by The Financial Brand, Finovate, CFO Outlook, CIO Insights, and Credit Union Times. He has been quoted in the Wall Street Journal, the Boston Globe, The Financial Brand, the American Banker, and the Boston Business Journal.

Manny Maceda

Worldwide Managing Partner, Bain & Company San Francisco Bay Area

Dr Hulme founded London’s largest private pure AI consultancy, whose 100+ team of experts use innovative AI techniques to solve hard problems for multinationals around the world. His company provides a unique algorithmic technology professional services to solve industry-specific optimisation problems.

He is the Director of UCL’s Business Analytics MSc, applying AI to solve business, governmental and social problems. He is passionate about how technology can be used to govern organisations and bring positive social impact. Hulme’s work outlines a framework for understanding data-driven decision making. Dr Daniel Hulme has advisory and executive positions across companies and governments. He holds an international Kauffman Global Entrepreneur Scholarship and actively promotes purposeful decision making. He is a popular speaker for Google and TEDx, and is a faculty member of Singularity University.

Sonya Brown

General Partner and Co-Head of Growth Equity,

Norwest Venture Partners,

Palo Alto, California

Sonya Brown is the General Partner and Co-Head of Growth Equity of Norwest Venture Partners. This firm manages over $9.5 billion in capital and has invested in more than 600 companies. She has 20 years of investment experience and focuses on consumer products and services, eCommerce, retail, and business services. Her current investments include Jolyn, Junk King, Kendra Scott (recapitalized by Berkshire Partners), SENREVE, and SmartSign.

Mary Callahan Erdoes

CEO, Asset and Wealth Management, J.P. Morgan

JPMorgan Chase

Mary Callahan Erdoes is the Chief Executive Officer of J.P. Morgan Asset & Wealth Management, an organization recognized as a global leader in investment management and private banking with over $4 trillion in client assets. She is considered one of the 25 most powerful women on Wall Street. She has also been enlisted in the 50 Most Influential list of the Bloomberg Markets. Mary Callahan Erdoes is a board member of Robin Hood, the U.S. Fund for UNICEF, and the U.S.-China Business Council.

Sunish Sharma

Co-CEO, Managing Partner, and Founder, Kedaara Capita,

Mumbai, Maharashtra, India

Sunish Sharma is the Co-CEO, Managing Partner, and Founder of Kedaara Capital Advisors LLP, India's popular private equity fund. He is considered one of the top 20 professionals who represent the future of Indian Business. He is also known as one of the Asia’s top 25 most influential people in private equity.

Key Takeaways and Learning Outcomes

- How private equity originated and impacting on corporate finance 2.0

- How private equity and corporate finance interplay

- How different phases of private equity and investment work

- How to deal with various steps of the investment process and due diligence

- How funding sources are managed, utilized, and generate benefits

- How to handle legal issues and taxation in private equity

- How to deal with private equity management

- How mergers and acquisitions and property PE work in practice

- How to perform a valuation of LBOs and calculations for performance distribution

- How to deal with private equity to reduce risk factors and maximise returns

How This Masterclass Prepares You For Success

- Build Confidence

- The Background and Sources

- Mastering the Management Skill

- Strategies for Successful Merger & Acquisitions

- The Key Points to Be Successful in Private Equity

- WHO SHOULD ATTEND....CEOs & Boards. C-Suite: CFO, CIO/CTO/CMO. Directors of Strategy, Data, Compliance, People/HR, Risk, Security. Analysts. Investors and PE/VC/Corporate Finance/M&A specialists

Gain your certified masters diploma

CMD is the ‘gold standard qualification’ for high-achievers! Get prepared to truly transform your business.

- Gain DEEP industry “insider” knowledge

- Practical, hands-on experience & insights from fast-moving, innovative companies

- Real transfer of knowledge

- Distinguished credentials from the world's top business schools and from real-life use cases

Real Results = Greater Impact

Customer experience means everything to us. Listen to what people like you are saying…

CLIENTS: Trusted By The World's Top Brands

Book Now & Save!

Avoid the Wait List. Prices will increase by $1000 in:

(And only 8 seats remaining as of this minute!)

RECOMMENDED FOR YOU

View All Certified Events…

Private Credit Masterclass

LIVE from July 2022...

Entrepreneurship Strategy Bootcamp

LIVE from July 2022...

Project Finance Academy

LIVE from July 2022...

Real Estate Modelling

LIVE from July 2022...

Corporate Finance & Valuation

LIVE from July 2022...

MBA in Financial Management & Profitability

LIVE from July 2022...

Financial Modelling & Power BI

LIVE from July 2022...

MBA in Oil, Gas & Clean Energy

LIVE from July 2022...

CyberSecurity Certified

LIVE from July 2022...

Data Science & Visualisation Certified

LIVE from July 2022...

Blockchain, Crypto & NFT Certified

LIVE from July 2022...

Private Equity 2.0 Certified

LIVE from July 2022...

Artificial Intelligence Certified

LIVE from July 2022...

Sustainability & ESG Certified

LIVE from July 2022...

Digital Transformation Certified

LIVE from July 2022...

Certified Digital Banker

LIVE from July 2022...

Certified Diplomas For Successful Executives

We reach 350,000+ senior professionals: CEOs, Directors & Investors. PARTNER with us to access the right clients worldwide!